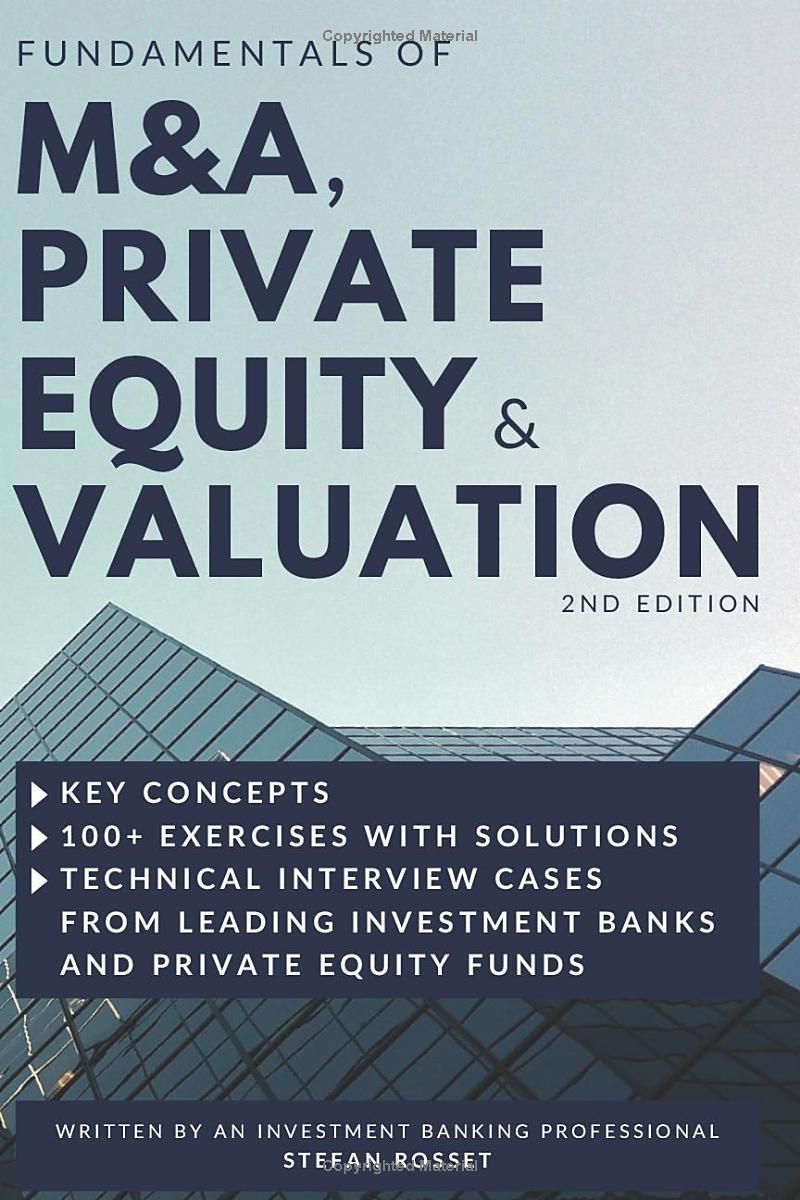

Master the intricacies of corporate finance with Stefan Rosset's "Fundamentals of M&A, Private Equity & Valuation." This comprehensive guide provides a clear and concise introduction to mergers and acquisitions (M&A), private equity, and valuation methodologies. Learn essential accounting and financial analysis concepts, explore diverse valuation techniques through detailed examples, and understand the complete M&A process. The book delves into the core principles of private equity and features over 100 practical exercises and technical interview questions, mirroring real-world scenarios from top investment banks and private equity firms. Whether you're a student or a seasoned professional, this book equips you with the knowledge and skills necessary to excel in the field.

Review Fundamentals of M&A, Private Equity & Valuation

Let me tell you, I devoured Stefan Rosset's "Fundamentals of M&A, Private Equity & Valuation," and I'm still buzzing from it! It’s not often you find a finance textbook that's both incredibly thorough and genuinely enjoyable to read, but this one manages to pull it off. The author clearly understands the challenges faced by someone trying to grasp the complexities of M&A, private equity, and valuation, and he addresses them head-on with a clear, accessible style. Forget dense academic jargon – this book speaks your language, using straightforward explanations and real-world examples to illustrate key concepts.

One of the things that immediately struck me was the book's structure. It expertly navigates the intricate web of accounting principles, financial analysis techniques, and valuation methodologies, breaking down each element into digestible chunks. The progression is logical and well-paced, building a solid foundation before diving into more advanced topics. There's a fantastic balance between theory and practical application, which is crucial for truly understanding this material. You don't just passively absorb information; you actively engage with it.

And speaking of engagement, the inclusion of over 100 exercises and technical interview questions is a game-changer. These aren't just filler questions; they're carefully crafted to challenge your understanding and solidify your grasp of the material. The real-world case studies, drawn from actual interviews at top investment banks and private equity firms, provide invaluable insight into the kind of questions you can expect to encounter in the professional world. This practical focus is what sets this book apart. It’s not just about passing an exam; it’s about equipping you with the skills and knowledge you need to succeed in a highly competitive field.

I especially appreciated the detailed explanations of different valuation methodologies. The author doesn't just present formulas; he walks you through the reasoning behind each method, highlighting their strengths and weaknesses, and demonstrating how to apply them in various scenarios. This attention to detail is invaluable. The step-by-step approach makes even the most challenging concepts manageable, building your confidence as you progress.

Whether you're a student aiming to break into the world of finance, a seasoned professional looking to brush up on your skills, or someone preparing for those notoriously tough finance interviews, this book is an absolute must-have. It's a comprehensive resource that not only imparts essential knowledge but also equips you with the practical tools to apply that knowledge effectively. I can honestly say that it’s one of the best investments I've made in my professional development, and I wholeheartedly recommend it to anyone seeking to master the fundamentals of M&A, private equity, and valuation. It's simply that good.

Information

- Dimensions: 6 x 0.55 x 9 inches

- Language: English

- Print length: 241

- Publication date: 2024

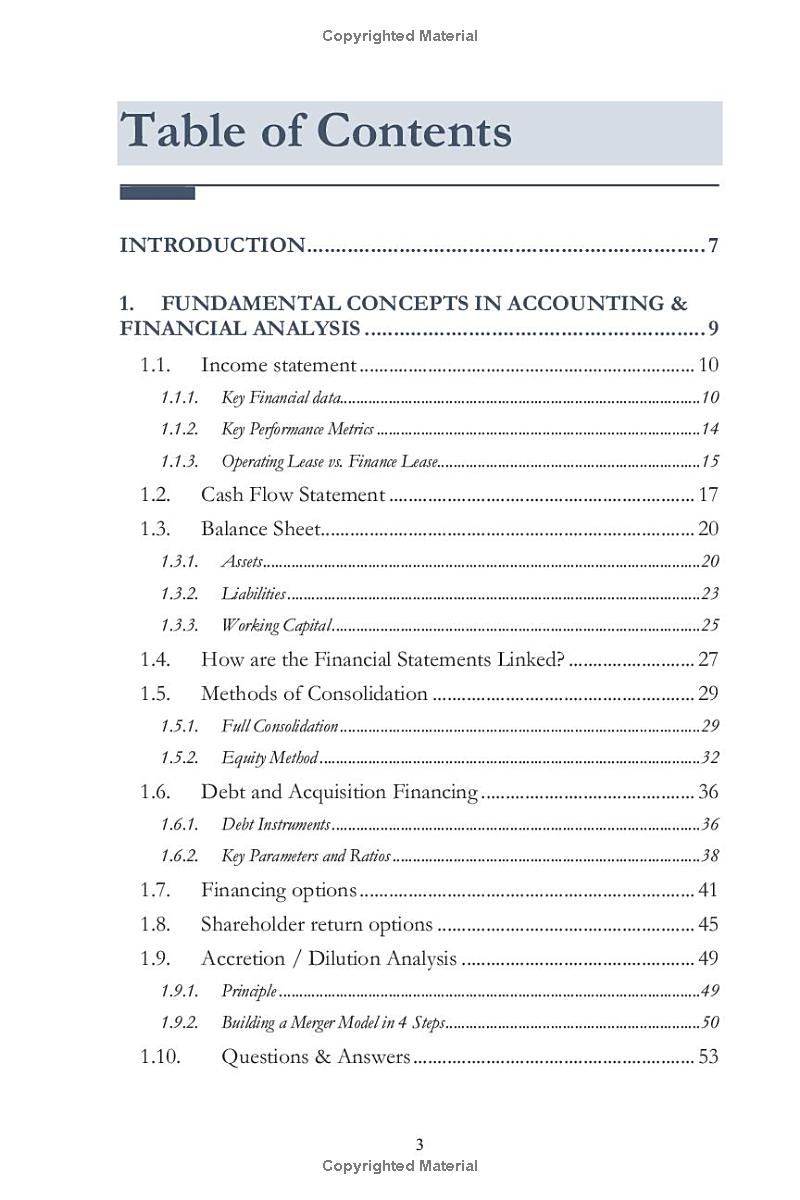

Book table of contents

- INTRODUCTION

- FUNDAMENTAL CONCEPTS IN ACCOUNTING & FINANCIAL ANALYSIS

- How are the Financial Statements Linked?

- Methods of Consolidation

- Debt and Acquisition Financing

- Shareholder return

- Accretion Dilution Analysis

- VALUATION METHODOLOGIES

- Approaches for Assessing Company Value

- Understanding Business Valuation

- Comparative Analysis of Valuation Methodologies

- Value and Price

- Discounted Cash Flows (DCF)

- Step 1: Project Company's Future Cash Flows.

- Calculation of the CoE and WACC.

Preview Book